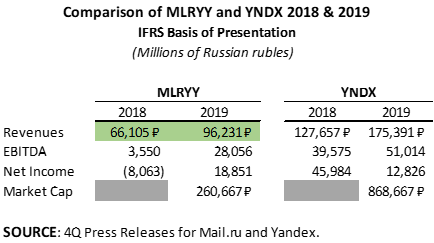

As I researched two articles on Yandex (NASDAQ: YNDX), the "Russian Google," one local competitor kept developing again and again: Mail.ru (other OTC / gray Market: OTC:MLRYY). As many readers will don't have any concept about either enterprise, MLRYY competes with YNDX to some diploma throughout almost all web verticals, however is a smaller enterprise:

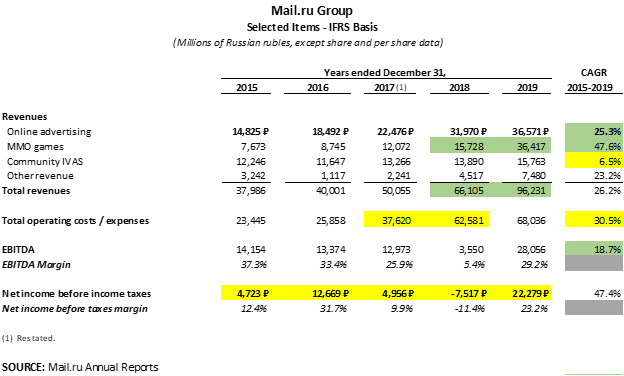

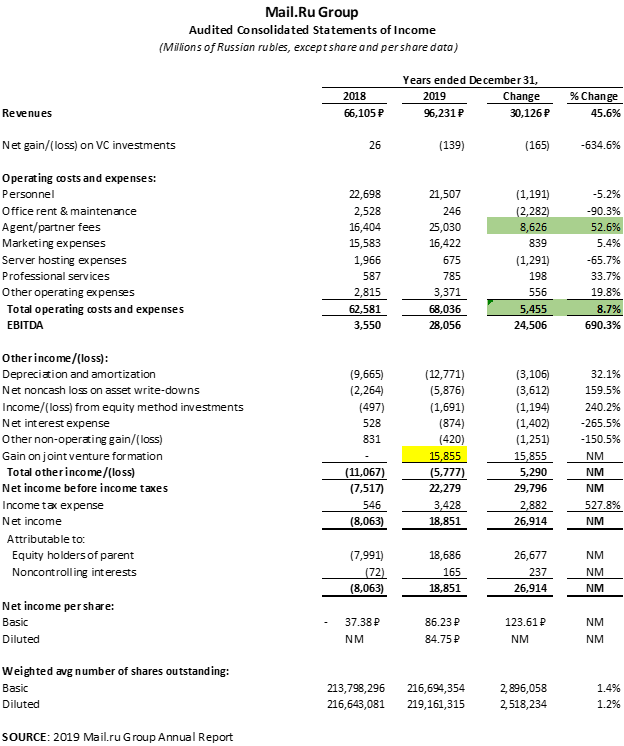

word the eco-friendly highlight? MLRYY grew revenues forty five.6% last 12 months - however a lot of that growth become because of acquisitions - compared to 37.four% for the greater-known YNDX. That deserves further investigation. in addition, MLRYY's 29.2% EBITDA margin turned into somewhat more suitable and, although mostly the outcome of some special situations at YNDX, the smaller enterprise mentioned better web earnings.

Is it price taking a look at MLRYY? smartly, most statistics suggest that about one hundred million of Russia's population of about 145 million are information superhighway users. That's a stunning large market - and that's now not counting Russian-speakme former u.s.a.S.R. nations.

a brief historical past: A Fencing Champion and Russian OligarchsMLRYY is a survivor; emerging from the darkish mists of the cyber web twenty years in the past. In 1995 Russian émigré Eugene Goland headquartered DataArt, a U.S.-primarily based software engineering company. a gaggle of Russian programmers working for DataArt created an internet mail carrier (therefore, the "mail.ru" name) which fashioned the core of Port.ru, an organization established in 1998 via Eugene Goland, Michael Zaitsev and Alexey Krivenkov. In 1999, Port.ru bought a venture capital investment from Baelstra Capital Fund, led with the aid of financier and fencing champion James Melcher. different project capital investments followed. through 2000, Port.ru had created a couple of verticals together with Mail.ru, Base.ru, go back and forth.ru, Postcards.mail.ru, record.mail.ru, talk.ru and score.port.ru.

Port.ru's attempts to finance building of e-commerce, a search engine and other initiatives ended with the loud pop of the dot-com bubble. In 2001, Yuri Milner, these days, in keeping with Forbes, "Russia's most influential tech investor," but then leading a small cyber web incubator called NetBridge, orchestrated a merger with Port.ru assisted by means of Igor Linshits, who had helped form ingredients of Lukoil (OTCPK: LUKOY), changing the name of the company to Mail.ru and fitting CEO.

In 2003, Milner resigned as CEO, but remained as chairman, and fashioned Digital Sky technologies ("DST"), a web challenge capital business. In 2006, Linshits sold his stake in Mail.ru to Tiger Fund and DST for an volume reportedly in excess of $a hundred million. In 2008, Alisher Usmanov, a billionaire Russian oligarch and - apparently - president of the Fédération Internationale d'Escrime, the international governing physique of fencing, additionally grew to be a shareholder.

In September 2010, the company merged with DST, adopted the Mail.ru neighborhood identify and Dimitry Grishin, founding father of Grishin Robotics, joined the business as CEO. In November, MLRYY went public on the London alternate, elevating about $912 million, implying a total valuation of $5.7 billion.

In March 2012, Milner stepped down as chairman and from the board of directors. CEO Grishin become named chairman. At this point, the company had attained its existing company constitution and route.

An Ecosystem: Spaghetti in opposition t the Kitchen Wall"Ecosystem" is a latest buzzword describing theoretically interrelated corporations that act to help and complement every other. it's above all normal amongst cyber web organizations as it lends a reason, despite the fact specious, for any set of web verticals and ancillary corporations thrown like sticky spaghetti in opposition t a kitchen wall. That brings us to MLRYY.

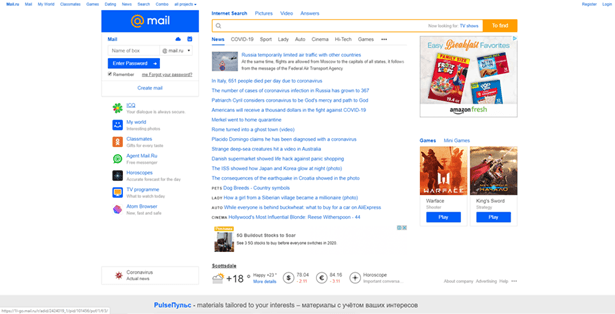

if you talk over with mail.ru you are traveling the critical portal for every thing the enterprise does; the kitchen wall that connects all that sticky spaghetti. here's what you see translated into English:

source: mail.ru

As that you could see, there are headings for verticals like electronic mail, video games, relationship and news. so that we can profit an improved knowing of the enterprise, I'm going to overview and grade each essential company phase. notice that what I've identified as company section doesn't line up exactly with MLRYY's monetary reporting.

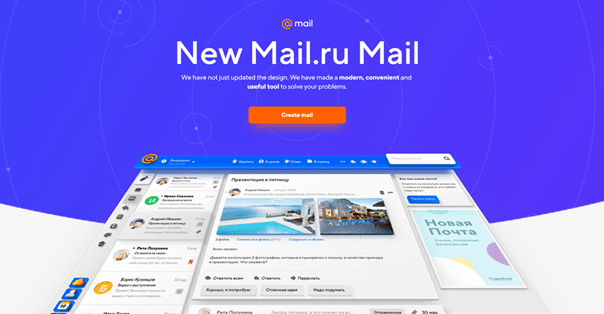

e-mail functions: No.1 in Russiae mail was the enterprise's long-established raison d'etre. besides the fact that children now various, the enterprise nevertheless operates the greatest free e-mail service on the RuNet, the "Russian web" - those domain names ending in "ru." MLRYY's free email comprises limitless mailbox dimension, attachments up to twenty GB, antivirus and antispam insurance plan, etc. besides the fact that children the enterprise claims to be one of the vital "excellent 5 global electronic mail capabilities via each day audience," its a hundred million active money owed make it a bit of-half player on the realm stage. in terms of money owed, Google's (NASDAQ: GOOG, GOOGL) Gmail is frequently mentioned as No.1 on this planet with over 1.5 billion, however the combined market share of Apple's (NASDAQ: AAPL) iPhone, iPad and Apple Mail is bigger when it comes to put in e mail consumers.

In Russia, based on e-mail debts, facts suggest MLRYY isn't any.1 with forty eight.7%, Yandex isn't any. 2 with 32.5% and Google is not any.three with 13.6%. through any general, besides the fact that children, the business's email provider is state-of-the-artwork. right here's the primary informational signal-up splash web page in English:

source: mail.ru

email isn't a excessive-boom product. in line with Palo Alto, California market analysis company Radicati, the variety of electronic mail accounts grew about 6% to 7% and the variety of electronic mail clients grew about three% per yr from 2015 to 2019. Radicati expects the number of e mail clients to continue to increase at a sluggish but constant 3% per year through 2022.

MLRYY's cloud storage product, Cloud Mail.ru, is a part of the electronic mail features section. a relatively new purchaser-oriented provider, Cloud Mail.ru provides users with cloud storage for all normal mobile and computing device platforms. The email functions phase additionally includes Search Mail.ru, seeing that 2013 MLRYY's in-residence developed search engine. Search Mail.ru isn't any.3 in the Russian search market, but this skill little as, in keeping with Russian search engine optimisation enterprise AURORA, its market share so far in 2020 was hovering around 2%.

Grade: A-

State-of-the-paintings e mail.

E-commerce: No.1 in food delivery in RussiaMLRYY become late to the e-commerce birthday celebration, but, with new partners state-managed Sberbank (OTCPK: OTCPK:SBRCY) and Alibaba (NYSE: BABA), is poised for true progress. The business's e-commerce phase comprises beginning club, the greatest on-line food start platform in Russia, Citymobil, a taxi and trip hailing carrier, Youla, a "area based mostly" marketplace and Pandao, a pass-border e-commerce platform.

The fragmented e-commerce market is growing all of a sudden in Russia. based on an editorial entitled "Russian E-Commerce Market Grows by 26%" in the September 3, 2019, edition of The Moscow times:

Russians have embraced e-commerce, which is turning out to be ten-instances faster than the true economic system and conventional retail. on-line revenue at the moment account for approximately four.5% of Russia's complete retail turnover, but that has been extra or less doubling each year in recent years and is on route to make up 8% of retail turnover through 2021.

in all probability due to the legendary winters, food delivery is increasing in recognition in Russia. Statista estimates that the Russian food beginning market will enhance at a 12.6% annual boom cost from revenues of $1.9 billion in 2019 to $three.0 billion in 2023. birth club holds the No. 1 market share amongst unbiased food birth groups. in accordance with a Deloitte CIS middle record, in 2019 restaurant-owned start accounted for sixty three% of the Russian food birth market with birth membership and Yandex.Eats following at 31% and 26%, respectively. The birth membership platform serves over 12,000 restaurants in over one hundred twenty cities with ninety% of orders per day made from mobile instruments. With their lime green uniforms, start membership's workforce are ubiquitous in Russian cities.

supply: rambler.ru

start club is growing to be abruptly; revenues elevated about RUB 2.5 billion or 131.2% from RUB 1.9 billion in 2018 to RUB four.four billion in 2019.

delivery membership and Citymobil, MLRYY's taxi and trip hailing product, bought a lift through a three way partnership finalized November 19, 2019 with $482.7 billion-asset Sberbank, Russia's biggest bank. Sberbank is within the technique of creating, predictably, "an ecosystem of easy on-line features in distinctive areas for any lifestyles cases." The financial institution partnered with Yandex to create Beru.ru, an e-commerce site, but amid rumors of companion battle, opt for MLRYY for food start and transportation capabilities.

The forty five% - forty five% three way partnership (10% reserved for compensation), called O2O for "on-line-to-offline," should be funded with RUB 47.0 billion in cash plus an further RUB 17.6 billion contingent on KPI's being met by means of November 2020 - a surprisingly brief period. About 80% of the overall possible money investment of RUB 64.6 billion might be offered by Sberbank. in terms of groups, MLRYY's foremost contributions were start club - the prize - and its 29.7%-possession in Citymobil (and a promise to up its stake to 80% before deal shut). Sberbank contributed its 35% share in SberFood, an online restaurant reservation and price provider. Per MLRYY's November 19, 2019 Press liberate, money funding in the three way partnership will be used "to pressure biological construction, consolidate assets and fund talents transactions in the meals-tech and mobility segments which are complementary to the existing O2O companies."

In a separate, however related transaction, Sberbank acquired 35% of the possession stake of MF applied sciences, a govt-controlled digital economic climate incubator, in MLRYY for RUB eleven.3 billion, giving the financial institution a small 1.eighty two% possession place however 20.3% of the balloting rights in MLRYY. Three years after the advent of O2O, Sberbank has the appropriate to request the approval of MLRYY's board of directors and shareholders for an change of Sberbank's share in O2O at reasonable market cost into no longer more than 20% of MLRYY's shares. For traders new to Russian companies, Sberbank or other state-controlled groups are familiar to funnel funds into agencies viewed as crucial to Russia, however the money at all times come with strings attached.

Does Citymobil matter? No, not yet. For 2019, based on a Royal bank of Canada (NYSE: RY) examine, taxi aggregators have been estimated to account for approximately 60% of the Russian taxi market, with Yandex.Taxi being the market leader with a 27% share. Vezyot, a fresh Yandex acquisition goal, money owed for 12% with Maksim at 9%, Gett at 5% and Citymobil at 1%.

When the Sberbank three way partnership closed, MLRYY's December 19, 2019 Press liberate claimed "the creation of Russia's main platform in mobility and food-tech," but Yandex, with its very effective Yandex.Taxi operation, arguably has the stronger combined "mobility and food-tech" product offering.

The different substantial business inside MLRYY's e-commerce section is Youla, a free mobile-first (about 60% of clients) labeled adverts site launched in 2015. The longer-term plan for Youla is to serve greater as a portal for verticals like auto, precise estate, and many others. Furthering the "ecosystem" theory, Youla is built-in with MLRYY's social community web sites Odnoklassniki ("ok") and VKontakte ("VK"). With 5.2 million exciting visitors in February 2020, as an instance, Youla ranked as the No. 2 conventional labeled website (private clients posting items) in Russia in accordance with Yandex.Radar, but lagged some distance in the back of Naspers (OTCPK: NPSNY) No.1 Avito.ru which had 46.1 million pleasing company. Like birth club, Youla is comparatively small, however growing impulsively with a profits boost of RUB 1.0 billion or ninety.9% from RUB 1.1 billion in 2018 to RUB 2.1 billion in 2019.

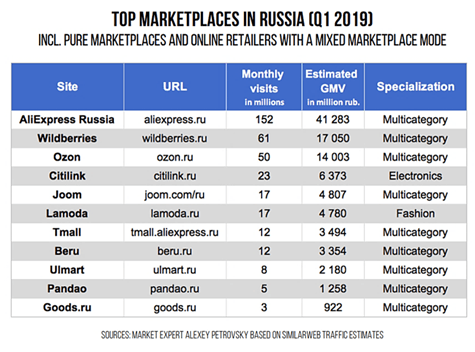

There is no really dominant e-commerce player in Russia like Amazon (NASDAQ: AMZN) within the U.S. MLRYY basically threw in the towel on its tenth place Pandao e-commerce market with the aid of getting into a complex joint venture with Alibaba. as the table under suggests, BABA's AliExpress was already the runaway No.1 e-commerce industry in Russia with 152 million monthly visits compared with sixty one million for No. 2 privately-owned Wildberries.

supply: East-Digital information Russian E-Commerce record up to date December 2019

The three way partnership, known as AliExpress Russia JV ("AER"), closed October 9, 2019 with 4 essential players - the second number after each and every owner's economic share equals vote casting rights:

notice that RDIF has a call alternative to acquire an extra 7.9% from Alibaba for $194 million. changed into this a pressured marriage? It's worth noting that no ownership aggregate permits Russian entities to personal under 50.1% of the balloting rights. i believe Mr. Putin determined that a chinese-managed and shareholder-owned entity turned into no longer going to be the No.1 e-commerce site in Russia. we will safely conclude that AER isn't any. 1 within the fragmented market of Russian e-commerce.

Grade: B+

needs work. The AER three way partnership with Alibaba saved MLRYY from irrelevance. Youla is promising, but lags some distance in the back of the market leader. It's too early to judge the three way partnership with Sberbank in food birth and ride-hailing, but the funding can simplest support.

Social Networks: No. 1 and No.2 and No.6 in RussiaMLRYY dominates the Russian social networking market with three very powerful choices, VKontakte ("VK), Odnoklassniki ("ok") and Moy Mir.

supply: Mail.ru

founded via Pavel Durov in 2006, VK is commonly called the "Russian fb." VK, "in touch" in English, is the No. 1 site in Russia - and surely the No. 1 social network site - by means of a couple of metrics. for instance, in keeping with web analytics provider Yandex.Radar, there were 184 million friends to VK in February 2020, compared to a hundred and fifteen million for No. 2 website adequate. when it comes to visits, market analysis firm SimilarWeb at the moment ranks VK as the No.1 web page among Russian social networks (No. 2 of all Russian sites to Yandex.ru) and No. 13 of all sites in the world. VK's web site describes the enterprise's mission as "…to join people, services and companies via creating basic and easy conversation tools."

VK become got with the aid of MLRYY via a sequence of transactions culminating in the September 16, 2014 buy of 48% from United Capital partners for $1.5 billion thereby achieving one hundred% ownership and manage. United Capital was headquartered via Ilya Sherbovich, who, in response to a June 26, 2013 article within the monetary times, "helped craft deals for americans close to Vladimir Putin during his career." After the alternate in control, CEO Durov left the country for Buffalo, manhattan where he and ex-VK personnel based Telegram, an encrypted messaging app with over 300 million clients.

supply: Mail.ru

founded in 2006 by way of Albert Popkov, ok, "classmates" in English, is the No. 2 social network in Russia. as the identify suggests, ok was at first designed to re-join classmates and old friends. As mentioned above, the web site's 115 million visitors in February 2020 ranked No. 2 to sister community VK. SimilarWeb presently ranks ok at the No. 2 web page among Russian social networks (No. 6 of all Russian web sites) and No. 23 of all sites on the earth. The platform is the leader in videos viewed amongst Russian social networks. In August 2010, before its merger with Mail.ru and November IPO, Yuri Milner's funding enterprise DST grew to become the a hundred% proprietor of good enough by using purchasing the closing 20% owned by means of founder Popkov.

![]()

source: Mail.ru

Moy Mir or "My World" is the No. 6 rating social network web site in Russia - and the No. three rating Russian social community web page - per Yandex.Radar with 11.8 million visitors in February 2020. The site was conceived and added by means of MLRYY's own in-residence group in 2007 as a portal to different MLRYY verticals but developed a life of its own as an independent social community. In 2015, MLRYY re-positioned the website to serve people with equivalent interests with an emphasis on track, video and games.

whereas the company doesn't get away revenue for every social network, the business's 4Q 2019 Investor Presentation indicated that VK emerged as the megastar with earnings increasing about RUB three.7 billion or 20% to RUB 22.1 in 2019 from RUB 18.four billion in 2018.

Grade: B+

Dominant local market position, slower growth being re-charged by new investment and tighter center of attention on monetization.

immediate Messaging: Bit playerMLRYY owns three immediate messaging purposes; TamTam, ICQ and Agent Mail.ru. These functions assist and complement other ingredients of the "ecosystem," however additionally attain a big part of the Russian viewers it is mobile-only. TamTam - mobile only - appears probably the most totally developed with primary points like texting and the capacity to place HD-exceptional audio and video calls, augmented by way of chat companies, moderated channels, unlimited cloud storage, the ability to send data as much as 2 GB plus an embedded mini-participant for video and audio messages. The other applications, ICQ and the vaguely bloodless struggle-sounding Agent Mail.ru are extra basic and available in cellular and desktop models. when it comes to monthly active clients, MLRYY's messaging purposes are additionally-rans with TamTam reporting 7 million "registrations," ICQ eleven million and Agent Mail.ru 18.eight million. To provide you with some thought of the dimen sion of messaging purposes, as of October 2019 in accordance with Statista, the three greatest , fb's (NASDAQ: FB) WhatsApp and Messenger and Tencent's (OTCPK: TCEHY) WeChat had 1.6 billion, 1.three billion and 1.1 billion month-to-month lively clients, respectively. Any monetization of the three MLRYY messengers aren't significant.

Grade: C-

first rate items, helpful as part of MLRYY "ecosystem," but lack vital mass.

games: The increase EngineThe video games section makes MLRYY "eastern Europe's leading on-line amusement company" and is big to the enterprise in terms of clients, profits and boom - however now not so gigantic on the area stage. The video games section contains 5 regional offices in Russia, Europe and the U.S., more than 1,500 staff and 9 developer studios. MLRYY owns, has published or is setting up about 115 video games. games income primarily carries the buy by players of in-game virtual gadgets representing extra functionality and lines and licensing arrangements with third events to operate video games in different countries and regions.

cyber web games are a tremendous enterprise international. Per a June 2019 document from market analysis company Newzoo:

There are actually greater than 2.5 billion gamers across the world. combined, they are going to spend $152.1 billion on video games in 2019, representing a rise of +9.6% yr on year.

In Russia, revenues from digital games are starting to be abruptly because the predominant "free-video game" way of life fades and players adapt to buying their game experience. In a report posted in November 2019, Superdata estimated that Russia would surpass France in 2019 as Europe's third greatest digital game market with a 57% enhance from $1.7 billion in earnings to about $2.7 billion.

Digital games are MLRYY's second most critical profits supply accounting for approximately 37.eight% of complete 2019 profits. It's a huge boom enviornment as neatly; the business stated RUB 36.4 billion in video games revenue in 2019, up an excellent 131.8% from RUB 15.7 billion in 2018. to position this in viewpoint, youngsters, that's $582.5 million in video games revenue or 0.0004% of the entire 2019 $152 billion world digital games market. MLRYY's total registered consumer base across all platforms is 605 million, however in keeping with Wikipedia there are 28 single workstation-based games and 27 cellular-primarily based games from lots of developers and publishers with more than 100 million registered clients - and two with greater than 1 billion.

to be able to concentrate its efforts within the games section, administration adopted the My.games manufacturer in mid-2019 as an umbrella for all digital video games items. My.games operates in 4 areas; 1) client, 2) cell, three) Esports and 4) Investments.

in the customer enviornment, MMO / mmo items ("massively multiplayer online" / "massively multiplayer online position playing video game") like Warface, ArcheAge and ideal World are developed by independent studios or in-residence and published or co-posted by My.video games.

Warface, the No. 1 computing device-based mostly (i.e., the pc is the on-line access point) video game in Russia, is a great example. It changed into developed by Crytek GmbH, an independent German video games developer and co-posted by My.games and Microsoft (NASDAQ: MSFT).

supply: My.games.ru

according to Newzoo, cellular structures worldwide accounted for roughly 45% of all digital gaming, transforming into about 10.2% to reach an estimated $sixty eight.5 billion in 2019. In Russia, per Yandex, cell gaming accounted for 34% of profits and expanded at a 29% cost over 2019. MLRYY's cell games are neatly-placed in the Russian cellular market, accounting for sixty four% of games section revenue in 2019 with a goal of accounting for eighty% by 2022. i think few U.S. gamers should be universal with My.games cellular video game titles like Hustle fortress, Hawk: Freedom Squadron or Left to survive.

supply: My.video games.ru

Esports are a fairly new phenomenon. primarily as promoting, MLRYY sponsors and organizes tournaments and declares that includes online multiplayer games. The business has subsidized more than 200 tournaments with mixed prizes of over RUB 40.0 million over the last 5 years.

when we overview MLRYY's financials - specifically the growth within the video games enviornment, we'll see how neatly Mail.Ru games Ventures ("MRGV") suits into the company's plans for games. MRGV invests in promising video games and gaming companies - up-and-coming online game developers in addition to based studios in want of extra supplies for scaling their business. The latest portfolio has more than 10 gaming initiatives, together with the cellular motion RPG Guild of Heroes from Russian studio BIT.video games and cellular online shooter Tacticool from Russian-Finnish developer Panzerdog. Like a customary challenge capital firm, MRGV offers investment, however also greater in-depth advertising and marketing and operational guide. MRGV seeks to both publish the game project below construction for the Russian or accelerated market or ideally roll-up the video game developer and procure all rights through acquisition.

Grade: B+

A small however up-and-coming participant on the earth's on-line gaming market.

B2B: Leveraging In-house skillsMLRYY offers a number of business-oriented tools and functions, which on a mixed basis grew RUB 532.7 million 141.0% to RUB 1.0 billion in 2019 from RUB 467.3 in 2018. The crown jewels of its B2B choices; MyTarget and MyTracker, had been at the start developed as in-apartment equipment. MyTarget is an advertisement platform proposing companies access to web and mobile users of the largest functions and social networks in Russia and the CIS, together with over 6,000 third-birthday celebration functions and mobile sites. MyTracker is the biggest cell analytics platform in Russia proposing developers and advertisers with predictive analytics, exact statistics and other counsel concerning the mobile clients of a product.

different features consist of:

There are also functions and software for predictive consumer analytics, mailing listing management, and written content material analytics.

Grade: B

quick-growing but rather insignificant (about $sixteen.0 million in revenue per yr) monetization of in-residence developed methods.

Media: solid Verticals for the Russian MarketMLRYY's present media verticals are the sophisticated and advanced successors to the verticals at the start created with the aid of predecessor company Port.ru circa 2000. nowadays, MLRYY owns 11 well-known on-line media substances:

name

area rely

guests/Month

(thousands and thousands)

high-Tech Mail.ru

news/reviews of excessive-tech utility and hardware

9

lady Mail.ru

Most regular Russian-language website for ladies with information, video clips, columns, how-to articles, and so on.

20

Auto Mail.ru

Articles, information, reviews, movies, and references materials for car fans.

4.9

information Mail.ru

World and local every day information supply for Russia and CIS states.

13.2

fitness Mail.ru

Most regularly occurring Russian-language website for fitness and medical suggestions.

sixteen.1

children Mail.ru

Most Russian-language time-honored web page dedicated to mothers and children.

11.3

Cinema Mail.ru

information, articles, movies, stories, schedules and online streaming for tv and movie enthusiasts.

5.8

Realty Mail.ru

residences, properties, and business houses for sale or hire.

2

Pets Mail.ru

news, articles, movies and product stories for pet house owners.

~0.5

All Pharmacies

site for ordering medicines and clinical resources for pickup at native pharmacies.

~0.5

sport Mail.ru

news, articles, movies for activities fanatics, also pronounces events.

1.2

MLRYY does not give detail on promoting earnings and charges linked to its media homes.

Grade: A

a qualified "A" for a good set of verticals with a big Russian-speakme viewers, but are they making any funds?

administration: where are the Founders?We need to go into reverse somewhat right here. be aware Eugene Goland and his friends Michael Zaitsev and Alexey Krivenkov who created the usual e-mail core of MLRYY? be aware VK's founder, the mercurial however unbelievable Pavel Durov? How about Albert Popkov, founder of ok? None are now associated with the enterprise. there has been an incredible management and inventive technological vacuum. It's as if Jobs, Gates, Bezos, Zuckerberg and Musk had been pressured out of their a variety of enterprises early within the construction manner.

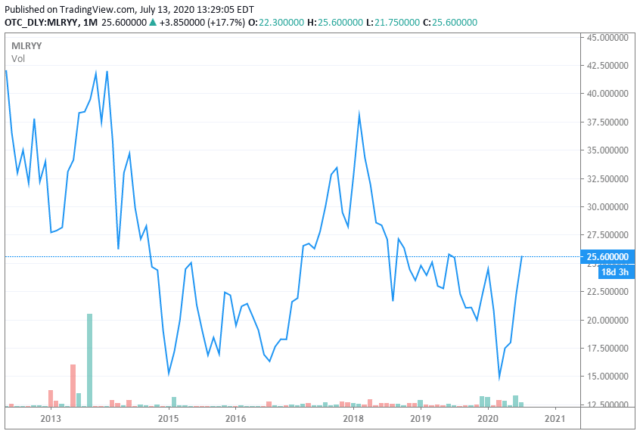

fiscal performanceThe business's financial performance has suffered from the shortcoming of founder-degree administration, technological information, creativity and strategic vision. while the MLRYY "ecosystem" might have the biggest audience in Russia and seize essentially the most screen time, it's done little for shareholders. The business has struggled to monetize its early benefits in e-mail and social networks in its core Russian and CIS market. present management may also have found a course to sustainable growth through joint ventures with robust companions and on-line video games, a risky and "hit-driven" market, but the genuine and potential increase has been obtained. The stock cost graph below indicates the influence.

source: TradingView.com

administration studies segment and different fiscal suggestions in two approaches; on a management accounting groundwork, peculiarly for phase counsel, and in accordance with IFRS, the overseas monetary Reporting standards set by way of the London-based international Accounting requirements Board (IASB). whereas I have used administration's accounting the place fundamental to give context and comparisons, all assistance introduced during this area is in response to IFRS.

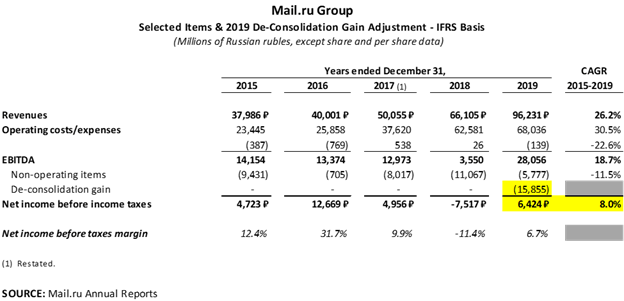

searching at the table below, investors have to ask no matter if the 2018 - 2019 period turned into the conclusion of the strategic drift and the beginning of sustainable increase. green is good, yellow dangerous:

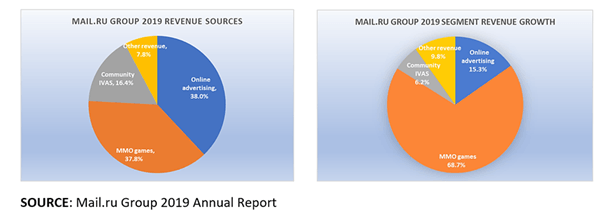

here's an easy way to examine the business's sources of income towards their 2018 - 2019 boom:

The legacy agencies of MLRYY; on-line promoting, community IVAS and different sources comprised 62.2% of income in 2019 however accounted for only 31.three% of earnings increase. MMO games accounted for 37.eight% of earnings, however 68.7% of profits boom. the long run primary growth driver is apparently MMO video games.

on-line promoting has grown at a 25.3% CAGR due to the fact that 2015 - that's decent. The growth has been constant and organic with the massive start in income, RUB 9.5 billion or forty two.2%, coming between 2017 and 2018 because of the company's renewed center of attention on "adtech" coinciding with the acceleration of the shift in customer advertising budgets in the Russian market to online and in online against video, cell and social networks. right through 2019, MLRYY's "adtech" and online promoting earnings were supplemented with the aid of the acquisition of Native Media LLC, a video advert platform.

We've touched on the stellar earnings growth in MMO games, a forty seven.6% CAGR from 2015 to 2019 - and 68.7% of MLRYY's salary boom between 2018 and 2019. the vast majority of the massive RUB 20.7 billion or 131.5% enhance in salary between 2018 and 2019 became biological increase as a result of current video games including Warface, Hustle castle and struggle Robots and new releases misplaced Ark and American Dad! Apocalypse soon. There was also a full-year 2019 contribution to profits from 2018 acquisitions ESforce, an esports company, and Bitdotgames Publishing restricted, a cell video games developer, and earnings contributions from two smaller 2019 roll-united states of americaof three way partnership mobile games developers Panzerdog and Swag Masha. In 2019, MMO games offered about RUB 5.2 billion or 18.7% of EBITDA on 37.8% of earnings.

neighborhood IVAS, our first yellow spotlight, grew at a 6.5% CAGR from 2015 to 2019, the slowest price among MLRYY's financial reporting segments. salary increase become better within the 2018 - 2019 length, besides the fact that children; a RUB 1.9 billion or 13.7% raise to RUB 15.eight billion from RUB 13.9 billion. Acquisitions throughout this duration helped enhance income. With the purchase of virtual presents, in-online game objects and fee features slowing, MLRYY has been rolling up joint ventures - lots of which assist or feature in assorted constituents of the "ecosystem" - at a speedy pace:

In December 2019 MLRYY got handle of educational online platform Skillbox by way of expanding its share to 60.three% paving the manner for yet one other three way partnership roll-up.

For all segments mixed, profits has extended at a 26.2% CAGR from 2015 through 2019, a extremely respectable cost of enhance, highlighted via the RUB 30.1 billion or forty five.6% enhance from 2018 to 2019.

working charges, a further yellow spotlight, extended at a 30.5% CAGR from 2015 to 2019, outpacing the 26.2% annual ordinary growth over the identical length, besides the fact that children, it's value noting that prices truly exploded between 2017 and 2018, up RUB 24.9 billion or 66.4% year-over-yr - preceding the huge 2018 - 2019 earnings boost. In other phrases, the investments appear to have paid off. apart from RUB four.three billion in stock compensation cost or about 17.2% of the boost, administration stated biological factors directly regarding elevated agent/partner fees and marketing charges.

The 18.7% EBITDA CAGR over the 2015 - 2019 length is more indicative of MLRYY's earning vigor than the forty seven.four% CAGR for internet salary over the same duration. The EBITDA margin indicates signs of stabilizing after falling to a low of 5.4% in 2018 - a 12 months which noticed huge investment prices. As we'll see in the more specified evaluation of 2018 and 2019 consequences, net salary has recently been discipline to good sized valuation and impairment charges and de-consolidation beneficial properties.

Chairman Grishin and CEO Dobrodeev collectively commented in fiscal 2019:

2019 has been a pivotal year for us in our strategic goal of transitioning into a web ecosystem, to be fashioned on the groundwork of our mighty and smartly-varied product portfolio in addition to complementary and neatly-funded partnerships.

The 12 months did indeed have the "feel" of an inflection point in keeping with the numbers; the establishment of a brand new, more reliable base for the company's future boom. there were 9 distinct consolidated acquisitions in 2019 in addition to two massive joint ventures. We've already noted that 2019's RUB 30.1 billion or 45.6% raise in salary over 2018 become preceded via the large RUB 24.9 billion or 66.4% raise in working prices from 2017 to 2018. these charges have been brought below handle within the 2018 - 2019 period - highlighted in eco-friendly above, increasing "just" RUB 5.6 billion or eight.7%.

essentially the most important quantity below, highlighted in yellow, is the RUB 15.9 billion profit on deconsolidation involving the Sberbank and AER joint ventures. MLRYY recognized gains from the contribution of RUB 14.9 billion on CityMobil and start club and RUB 1.0 billion on Pandao to the Sberbank and AER joint ventures, respectively. The deconsolidation benefit changed into equal to seventy one.2% of 2019 net earnings before taxes. with out that gain, net profits before taxes would had been approximately RUB 6.four billion in comparison to the stated RUB 22.three billion, a good deal greater indicative of the enterprise's constant-state earning power. besides the fact that children this adjusted internet earnings before taxes would nevertheless be the highest when you consider that 2016, the 2015 - 2019 CAGR for revenue before taxes drops to a mediocre 8.0% with this adjustment:

After tax unadjusted net income rose RUB 26.9 billion to RUB 18.9 billion in 2019 from a loss of RUB eight.1 billion in 2018, but we apply the equal 2019 15.four% tax cost to adjusted internet profits earlier than taxes we get about RUB 5.four million, a good increase, but no longer a home run.

What Do First Quarter 2020 consequences inform Us?Chairman Grishin and CEO Dobrodeev released this observation summing up 1Q 2020:

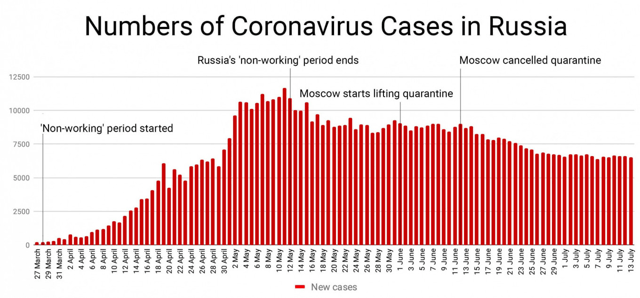

while the latest extraordinary circumstance ability that 2020 has began with some enormous challenges, we suppose highly well-placed given our profitability and neatly-assorted revenue streams. advertising, which bills for less than 40% of the community's revenues has a transparent correlation with local business efficiency and outlook, which all started to be impacted by the aggregate of COVID-19 and the oil shock in March. youngsters, MMO video games, which money owed for over 30% of revenues, has considered internet fine results when you consider that the returned end of March, certainly across natural home pc and console platforms.

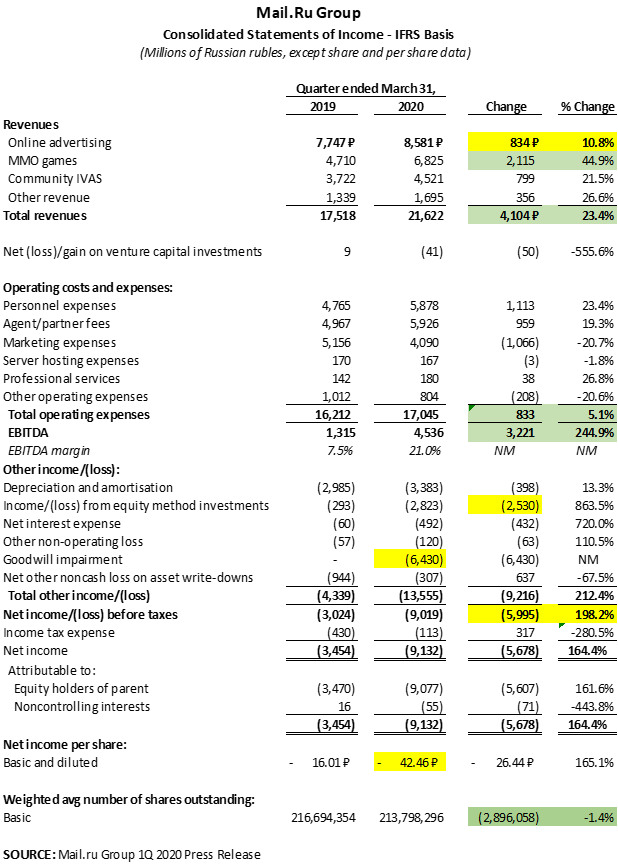

The constructing weakness in on-line advertising income - highlighted in yellow below - resulted in a comparatively small 10.8% increase over the prior length. on the grounds that the financial have an effect on of the coronavirus, management stated in the 1Q 2020 Press free up that this "should be would becould very well be the primary-ever 12 months that Russia's digital promoting market experiences a decline." MMO video games, the first eco-friendly highlight, persevered their surge with a RUB 2.1 billion or 44.9% enhance over 1Q 2018, providing fifty one.5% of the increase in 1Q 2019. in keeping with the 1Q 2020 Press free up, management seen a "rise in engagement" with its video games as the Russian executive all started issuing stay-at-domestic and closure orders in late March and early April.

source: the moscowtimes.com

expected to be at a low point in revenue boom 1Q 2020, video games as an alternative outperformed.

birth membership, the food birth business contributed to the Sberbank joint venture, has additionally experienced extraordinarily swift boom because of the pandemic with revenues increasing more than 210.0% to RUB 1.eight billion 1Q 2020. The carrier crammed an all-time excessive 3.seventy eight million restaurant orders in March, up 88% over March 2019. In early April birth club begun filling 1 million orders per week for the first time.

ordinary, complete revenues have been up a match RUB 4.1 billion or 23.four% to RUB 21.6 billion 1Q 2020 from RUB 17.5 billion 1Q 2019, exceeding management's 2020 increase information - which changed into withdrawn for all of 2020 on April 23.

working prices more suitable on the favorable trend centered in 2019, increasing simply RUB 833.0 million or 5.1% to RUB 17.0 billion 1Q 2020 from RUB 16.2 billion 1Q 2019. working fees are carrying on with to advantage from the deconsolidation of CityMobil, birth membership and Pandao, which all required heavy investment costs. in consequence, EBITDA - also a eco-friendly spotlight - greater than tripled from RUB 1.3 billion to RUB four.three billion quarter-over-quarter.

At this point the eco-friendly highlights conclusion, as MLRYY's share of the brand new joint ventures, both incurring heavy funding prices, became a RUB 2.8 billion 1Q 2020 net loss - the 2nd yellow highlight. MLRYY's new partners and expanded funding have accelerated the joint ventures funding phase, producing bigger "below the line" equity system accounting losses for the enterprise than it might have realized with less funding on a consolidated foundation where the affect would have hit EBITDA.

The subsequent yellow spotlight, a RUB 6.4 billion impairment cost, resulted from management's decision to conduct a coronavirus-inspired "stress-verify" of goodwill for all belongings. The evaluate resulted in the write-down of goodwill involving search, email, portal and instant messengers. All different belongings handed and no further write-downs are anticipated beneath latest assumptions. The write-down became equal to about four.5% of the RUB a hundred and forty.7 billion on MLRYY's steadiness sheet as of December 31, 2019.

The base line for 1Q 2020 became a disappointing RUB 6.0 billion net loss earlier than taxes, equivalent after a small tax benefit to a lack of RUB 42.forty six per share, down RUB 26.44 per share or 164.four% from the RUB 16.01 per share internet loss 1Q 2019. in the ultimate eco-friendly spotlight, management decreased shares surprising by about 2.9 million or 1.four% via open-market purchases.

To summarize 1Q 2020, we have first rate income growth, enhancing cost handle and a solid benefit in EBITDA. The benefit in EBITDA turned into a little bit illusory, however, as losses from e-commerce initiatives effortlessly migrated additional down the earnings statement to become losses from the new joint ventures. The simplest precise surprise was the impairment write-down. with out the impairment write-down, MLRYY would have pronounced a 1Q 2020 web loss before taxes of RUB 2.6 billion, about a 14% development over the 1Q 2019 net loss before taxes of RUB 3.0 billion 1Q 2019.

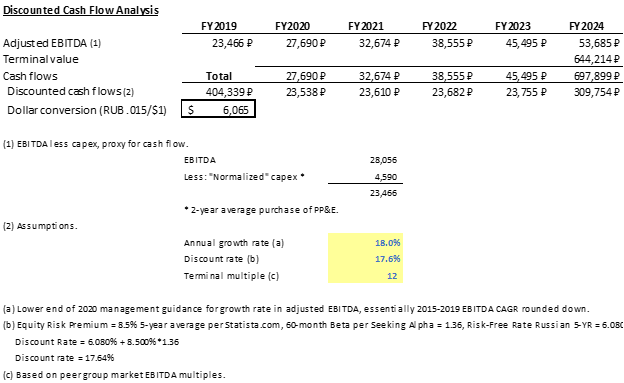

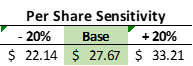

Valuation: 8% cut price to reasonable valueusual valuation ratios and most comparisons with an identical companies are uninformative for a non-SEC reporting Russian cyber web business and there's easily not satisfactory information offered by means of the enterprise to effort a sum-of-the-constituents valuation. I've fallen lower back on an easy, natural DCF. here it is:

The per share value in U.S. bucks is $27.sixty seven, about an 8% bargain to the last stated $25.60 per share price in U.S. dollars per E*exchange. right here's an easy option to bracket the per share values:

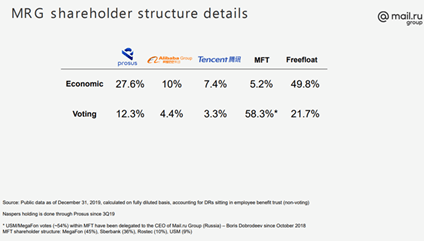

appear who owns massive items of MLRYY in this slide from the 4Q 2019 Investor presentation; the chinese, South Africans and the Russians. The 17.4% mixed financial pastime of Tencent and Alibaba and the 5.2% economic interest of MFT may as neatly have the chinese language and Russian flags marking their ownership percentages. How is it that Russia's MFT has a 5.2% financial activity and a 58.3% voting hobby? With any funding in a Russian business you have to be relaxed with cases of this class, but this one is strangely obvious - and it simply could work in want of the non-governmental traders.

source: mail.ru

while the owners of the 49.8% in free glide - primarily through the LSE besides the fact that children in March the board accredited a twin checklist on the Moscow trade - have a powerless 21.7% of the voting rights, there is an abilities to the shareholder structure. nearly $1.0 billion of capital flowing into joint ventures with MLRYY through two government-aligned entities did not happen by accident. There changed into also no reason for Alibaba's AliExpress to are seeking for MLRYY as a associate - unless they acquired an offer that become very difficult to refuse.

supply: newspunch.com

All investors advantage from the really low chance that Mr. Putin will ever allow MLRYY's shares to sink very low for long - and there's a lot of drive on administration to function. In a sense, Vlad has your back.

Conclusion: Pluses and MinusesIf these have been standard times, it would be effortless to suggest MLRYY as a speculative purchase for sophisticated investors with enormous portfolios in the hunt for publicity to the Russian market. These, besides the fact that children, don't seem to be typical instances.

Pluses:

Minuses:

MLRYY is not a stock for everyone. It's improved left to subtle investors with larger portfolios who already have journey with fairly low-volume international (preferably Russian) securities. if you're buying your first Russian tech stock, i'd suggest YNDX. for those who healthy this profile or are possibility-takers…

There's no hurry with MLRYY. It's apparent, with MLRYY checklist on the Moscow exchange (MCX) July 2, that management is in search of greater liquidity. As a final result, I agree with more desirable buying and selling action is likely on the manner in the U.S. OTC market as well.

when I first considered writing this article, MLRYY was trading around $15.00 per GDR and it turned into an obtrusive purchase. Now it's buying and selling at a 52-week excessive. I don't recommend buying the stock at this stage for the reason that 1) the margin of protection is low relative to MLRYY's historic volatility and a couple of) COVID -19 introduces too tons uncertainty into 2Q 2020 and 2020 earnings. if you're going to buy, wait until after 2Q 2020, evaluate the consequences and are seeking for a lessen entry aspect, might be around $20.00 per share.

at the appropriate price, MLRYY is a captivating speculative car for investing in the boom of the digital economic climate and online gaming in Russia and the CIS.

Disclosure: I/we have no positions in any stocks outlined, and no plans to initiate any positions within the subsequent seventy two hours. I wrote this text myself, and it expresses my very own opinions. i am not receiving compensation for it (apart from from looking for Alpha). I don't have any company relationship with any business whose stock is mentioned in this article.

No comments:

Post a Comment